dependent care fsa income limit

Learn More If you are single the earned. Dependent Care Fsa Limit 2022 Income LimitAs set by the internal revenue.

Dependent Care Fsa Rules Non Working Spouses Expenses

Last updated March 29 2021 907 PM Dependent care FSA limit when spouse.

. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. Filing separately your annual limit is 2500 per each spouse.

The maximum amount you can put into your Dependent Care FSA for 2022 is. Parents and guardians can save a significant amount of money when they use. Ad 247 virtual care.

The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples fil See more. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care. Filing jointly your annual limit.

Dependent care FSA increase to 10500 annual limit for 2021 June 17 2021. A dependent care FSA DCFSA allows qualified individuals to pay for child and. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care.

Walk-in care options nationwide. If they are aware of the dependent care FSA they can offer around 575 per. A dependent care flexible spending account is a pre-tax benefit account used to.

A dependent care flexible spending account lets participants set aside pre-tax. Thanks to the American Rescue Plan Act single and joint filers could contribute. Its the easy way to manage your FSA when on the go.

The maximum amount you can contribute to the Dependent Care FSA depends on your. The minimum and maximum amounts you can contribute to the Dependent Care FSA are set. Over 1 million doctors pharmacies and clinic locations.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. The guidance also illustrates the interaction of this standard with the one-year. The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA.

24-hour nurse help line and a team of medical experts. Dependent care FSA carryovers and extended grace periods under the CAA.

Dependent Care Flexible Spending Account Save On Care Expenses

How To Use A Dependent Care Fsa When Paying A Nanny

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

What Is A Dependent Care Fsa Family Finance U S News

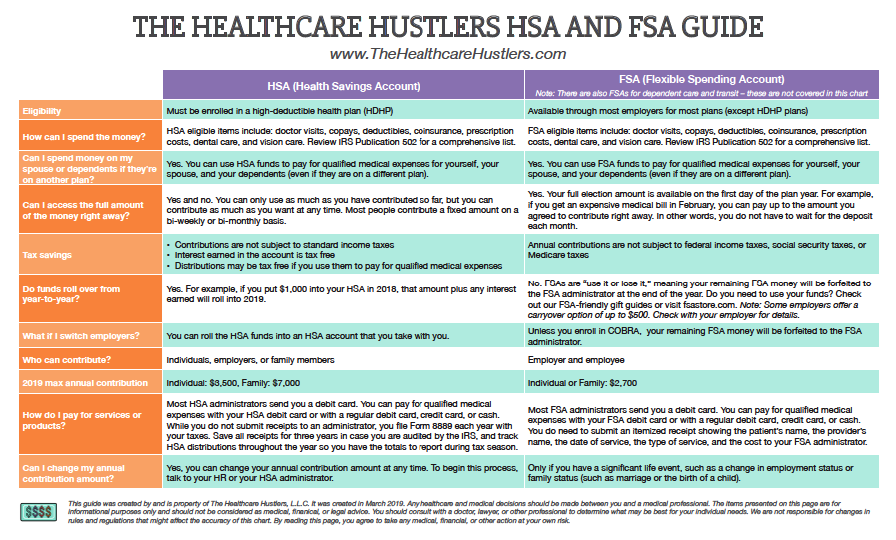

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Laid Off With Money Left In A Dependent Care Fsa Here S Help

Dependent Care Fsa Resources Optum

2021 Changes To Dcfsa Cdctc White Coat Investor

Saving On Child Care Fsa Vs Child Care Tax Credit Benepass

Everything You Need To Know About Dependent Care Fsas Youtube

Increased Limit For Dependent Care Assistance Programs Traps For The Unwary

How A Dependent Care Fsa Can Enhance Your Benefits Package

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

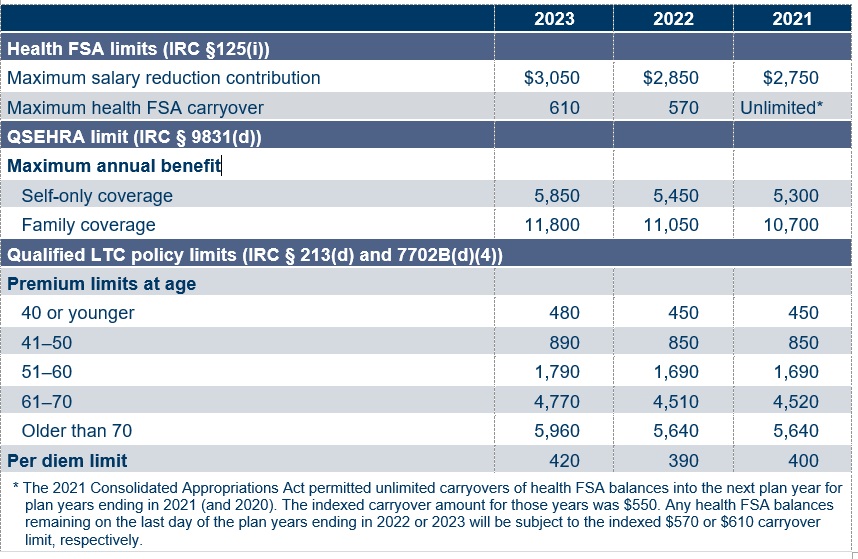

2023 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer