what food items are taxable in massachusetts

In general though retailers can use resale certificates to buy products they either intend to resell or rent or components of products they intend to resell. Sales Tax Exemptions in Massachusetts.

Is Food Taxable In Massachusetts Taxjar

Learn how to file a federal income tax return or how you can get an extension.

. Find a Food Bank in Your Area. The list includes items widely believed to bear the label like Reubens paninis club sandwiches and peanut butter and jelly sandwiches. The rates presented are current for the date and time you submitted the address but may change at any time with new tax legislation.

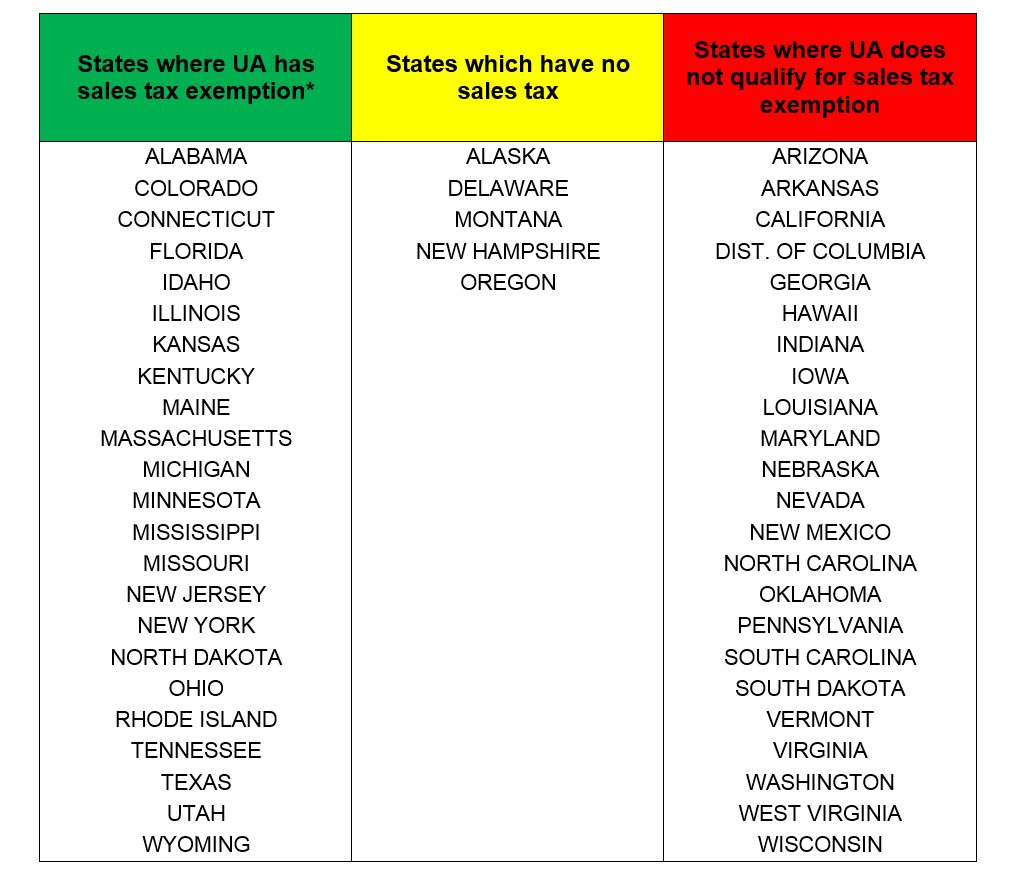

While the Massachusetts sales tax of 625 applies to most transactions there are certain items that may be exempt from taxation. In Massachusetts certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Food Banks and Food Co-ops.

To learn more see a full list of taxable and tax-exempt items in Pennsylvania. Food banks offer free groceries to people in need. Food Co-ops offer healthy foods.

Readers report that some food banks are adding delivery services. Forty-five US states and Washington DC all have their own sales tax rules and laws. See your sales tax rate applied.

This page discusses various sales tax exemptions in Massachusetts. Other exempt items include newspapers. This page describes the taxability of food and meals in Pennsylvania including catering and grocery food.

If the unitary business subject to Massachusetts apportionment has income derived from unrelated business activities as determined under 830 CMR 625A16d these items of income will be excluded from the taxpayers taxable net income and will not be apportioned to Massachusetts if Massachusetts does not have jurisdiction to tax the items of income under. Calculate your total amount. Be sure to apply the correct sales tax rate to your sale.

Clothing purchases including shoes jackets and even costumes are exempt up to 175. A product that costs more than 175 is taxable above that amount so a 200 pair of shoes would be taxed at 625 on the 25 above the exemption limit. However food and drugs are exempt from taxes as are health club memberships less-expensive clothing and footwear most arts and entertainment tickets and a host of other items.

Most food sold in grocery stores is exempt from sales tax entirely. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Resale Certificate Pro Tips.

We always recommend you read your states rules of resale certificates. Federal income tax returns are due on April 18 2022 for most of the country and April 19 2022 if you live in Maine or Massachusetts. While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels.

It then moves on to examples of taxable sandwiches. Many food co-ops are creating special hours where elderly and immune-compromised members can shop without crowds and stress.

Exemptions From The Massachusetts Sales Tax

Cisa Community Involved In Sustaining Agriculture Collecting Sales Tax On Farm Products

Taxes On Food And Groceries Community Tax

Massachusetts Sales Tax Small Business Guide Truic

Other States Tax Exemption Tax Office The University Of Alabama

Taxes On Food And Groceries Community Tax

Whole Grain Sourdough Bread Long Vs Short Autolysis Recipe Sourdough Sourdough Bread Whole Grain

Taxes On Food And Groceries Community Tax

Taxable Items And Nontaxable Items Chart Income Money Life Hacks Accounting And Finance